IS/LM

...sounds to me like it should be part of a tobacco pitch, but apparently not.

Some of you may recall that I'm something of a student of the Austro-Bahamian school of economics, as exemplified by the writings of its foremost exponent. Of course his works are occasionally a bit cryptic, even Derridesque, perhaps.

Anyway, he recently trashed the famous IS/LM model, which made me think that if it's that bad, I really ought to at least try to understand it.

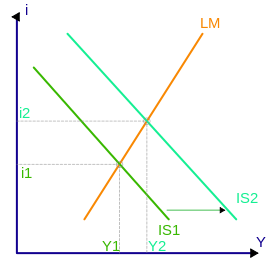

It seems that the model is actually two curves, often drawn as straight lines, in a space that represents interest rates (vertical axis) and gross domestic product (horizontal axis), as above. Now if you suspect that econo-space might have more dimensions than two, just consider it a two-slice of that hyperspace. The two curves represent hypothetical equilibria, with the participants being S, the propensity to save; I, the demand for investment; L, the so-called liquidity preference; and M, the money supply.

The working assumption is that propensity to save depends on the interest rate, and that the demand for investment depends on the interest in an inverse way. The market, in theory, should adjust interest rates until the supply of savings matches the demand for investment. Next we assume that the GDP depends on the interest rate, so that lower (real) interest rates increase GDP. Consequently, the IS curve is expected to slope downward and to the right.

The second curve is based on another posited equilibrium, that between liquidity preference (preferring to keep your cash in checking, or under the bed, instead of in bonds) on the one hand, and the supply of money that the Fed (or whomever puts in the system). Liquidity preference should decrease with increasing interest rates and interest rates should decrease with increasing money supply. Since GDP is expected to increase with increasing money supply, this curve is usually expected to slope upward to the right.

The intersection of these two curves, the first in what might be called in "real" space, and the second in"monetary" space, supposedly represents a grand equilibrium.

Problems and defects of IS/LM are discussed in A-B above, and in the Wikipedia article, both linked above. The meaning, use and applicability of the model to present circumstances is discussed rather nicely by Krugman.

Corrections to my interpretation welcomed.

Comments

Post a Comment